Master’s Programme: ACCOUNTING AND AUDIT

The master’s Programme “Accounting and Audit” is intended for applicants with a bachelor’s degree in Economics and/or Business Administration.

Form of study: full-time

Term of study for economists and non-economists: 3 semesters, admission from winter semester

Duration of study for students with a Bachelor's degree in PF 3.8 Economics with 180 or 210 credits: 4 semesters, admission from winter semester

Director: Prof. Eleonora Stancheva-Todorova PhD

e-mail: e_stancheva@feb.uni-sofia.bg

Administrator: Assoc. Prof. Iliana Ankova PhD

e-mail: iliana_ankova@feb.uni-sofia.bg

Application Requirements:

For application conditions, please refer to the general conditions (available in Bulgarian).

Tuition fees in Sofia University for the academic 2023 / 2024 year

Partners:

Aim of the programme:

To deepen and profile students' knowledge in the field of accounting, auditing and taxation. The curricula are fully aligned with the needs of practice. During their studies, students receive theoretical and practical knowledge and skills in: financial accounting; effective business management; taxation; international standards for financial reporting, including their application in the preparation of consolidated financial statements; international auditing standards; internal audit; analysis of financial statements and financial management.

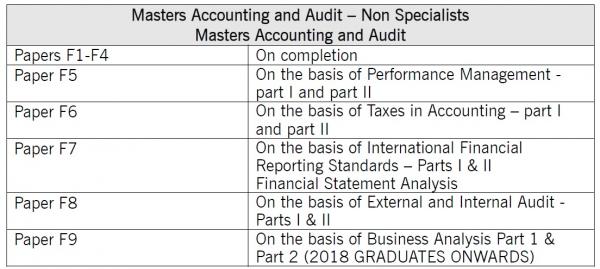

The programme is accredited by the professional body The Association of Chartered Certified Accountants (ACCA). Graduates are awarded nine out of 13 examinations for ACCA (Business and Technology; Management Accounting; Financial Accounting; Corporate and Business Law; Performance Management;Taxation; Financial Reporting; Audit and Assurance; Financial Management).

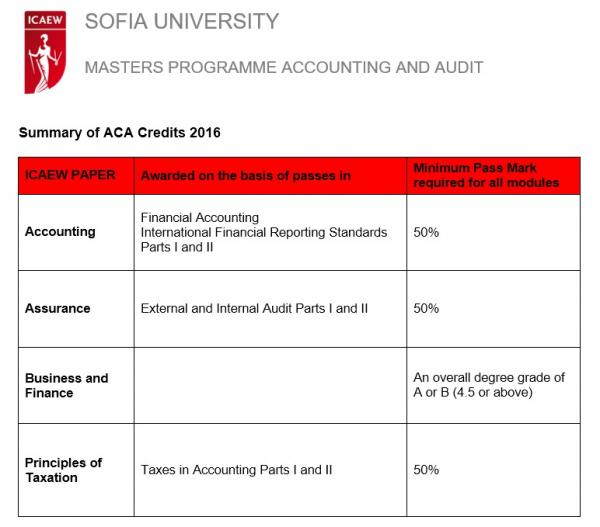

The ACCA qualification is internationally recognised and covers knowledge and skills in accounting, auditing, business and finance (http://www.accaglobal.com). It is preferred by many employers as it guarantees high professionalism and ethical behaviour on behalf of employees The programme is also accredited by The Institute of Chartered Accountants in England and Wales (ICAEW). The ICAEW Chartered Accountant Qualification (ACA) is one of the most prestigious in the world, providing key practical knowledge and skills in accounting, finance and business management and is highly valued by employers. It requires a total of 15 examinations, divided into 3 levels - certification, professional and advanced (https://www.icaew.com). Graduates of the Master's programmes are recognised by five examinations for the ACA qualification (Accounting; Assurance; Business,Technology and Finance; Management Information; Principles of Taxation).

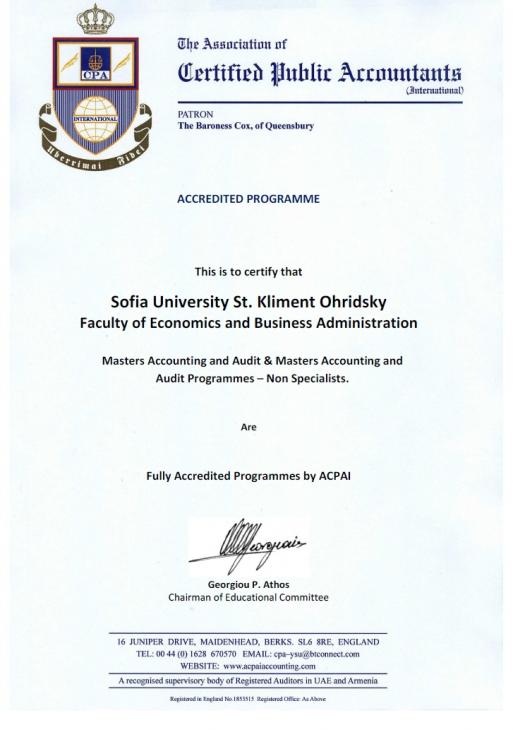

The programme has full accreditation from The Association of Certified Public Accountants Accountants (International), which enables graduates of the programme to obtain the professional qualification of CPA.

Many of the courses are co-taught by faculty staff and distinguished practitioners.

Graduates of the programme obtain the qualification of Master of Accountancy and Audit.

Graduates of the programmes can be employed as:

- operational and general accountants

- internal and external auditors

- tax consultants

- financial managers

- heads of departments and other corporate structures

- financial analysts

- inspectors and auditors in the tax and customs administration system

- other positions requiring accounting and control functions.

The duration of training is 1.5 years (3 semesters) and 2 years (4 semesters). for students with a Bachelor's degree in Economics with 180 or 210 credits. The four-semester Master's programme is structured in accordance with the need to incorporate into the curriculum additional courses to provide the required number of credits to obtain the Master's degree according to the legal requirements.

The Master's programmes in Accounting and Auditing are completed by the defence of a Master's thesis - for the three-semester Master's programme in July and November, and for the four-semester programme - in November and March.