Master’s Programme: ACCOUNTING AND AUDIT – NON-SPECIALISTS

CURRICULUM 2015/2016 (pdf)

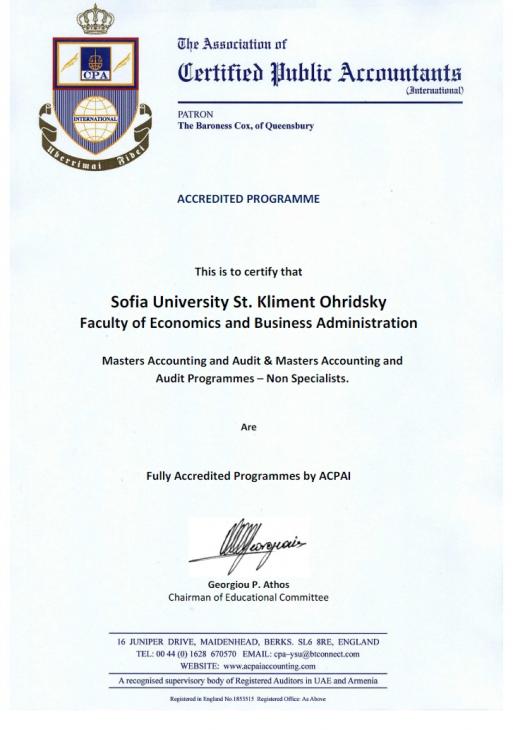

Partners:

Admission Requirements:

A bachelor’s or a master’s degree in a major different from Economics and/or Business Administration. Admission requirements include a written exam for testing applicants’ economic knowledge and language proficiency (an essay on economic issue of current interest) and an interview. The final grade consists of the grade point average of the bachelor’s degree, the state examination (defense of a bachelor’s thesis) and the grades of the essay and interview.

Programme Aims

The Programme’s main goal is to prepare highly skilled specialists – accountants, auditors, financial managers, etc., who could develop a successful professional career.

The additional Programme’s goals include:

- Improving and extending master-students’ knowledge in the field of accounting, financial reporting, auditing, taxation, economic analysis and financial control for acquiring new professional competencies;

- Deepening and expanding master-students’ knowledge in the field of dynamically changing national and international accounting legislation;

- Providing master-students with knowledge about management accounting specific tools and their application in practice;

- Providing more opportunities for a life-long learning.

The master’s Programme “Accounting and Audit – Non-Specialists” is in line with the policy and strategy of the Faculty of Economics and Business Administration for bringing the master’s programmes closer to business and responding to its needs for highly qualified and well prepared young specialist.

Programme content

The Programme’s curriculum includes:

- Foundation module (two semesters) – which includes basic obligatory courses with emphasis on economics and finance;

- Specialized courses in;Financial accounting;

- Management accounting;

- Financial reporting based on the International Financial Reporting Standards (IFRSs), incl. preparation of consolidated financial statements

- Financial Statements Analysis

- Audit and assurance procedures based on the International Standards of Auditing

- Taxation

- Accounting of Financial Institutions

- Public Sector Accounting

- Accounting of Insurance and Pension Insurance Companies

Professional competencies

BE FAMILIAR WITH:

- modern economic theories and be able to analyze the economic environment by using the appropriate tools;

- the legal and administrative basis of businesses;

- the structure and content of company’s financial statements;

- the consolidation procedures for preparation of consolidated financial statements;

- the tools of management accounting;

- the Conceptual Framework for financial reporting of International Accounting Standards Board;

- the requirements of the core set of the IFRSs;

- the nature of audit and assurance procedures, their principles and concepts;

- the Bulgarian tax system as applicable to individuals, single companies and groups of companies;

- the specific accounting of companies from different sectors – banks, government agencies, ministries, insurance and pension insurance companies, etc.

- Bulgarian accounting practices and accounting legislation.

BE ABLE TO

- implement what has been learned as theory and shared practical experience to solve practical problems;

- prepare individual and consolidated financial statements based on the IFRSs;

- take part in planning of an audit engagement;

- take part in assessing components of the audit risk and develop an adequate audit strategy;

- take part in different audit assurance procedures based on the International Standards of Auditing

- compute the income tax liabilities of individuals and the effect of national insurance contributions on employees and employers;

- compute the corporation tax liabilities of individual companies and groups of companies;

- compute the effects of value added tax on businesses;

- implement the management accounting tools;

- communicate effectively;

- use and work with various information sources.

BE

- creative;

- open to innovations;

- capable of self-development and life-long learning.

Professional development

Programme’s graduates can work as accountants and chief accountants of companies from different economic sectors, incl. financial and non-financial institutions, insurance and pension insurance companies, etc.; financial managers, department managers, tax consultants, internal and external auditors. They can also develop their professional career in other sectors and institutions through exercising accounting and controlling functions.

Programme’s graduates in Accounting and Audit – Non-Specialists can hold posts in the government administration, in third sector organizations; work as consultants; teach in the system of higher education, work in research and development units.